Will Duke and Daisy’s retirement spending plan work? If you’re a fan of hearing Joe Anderson, CFP® and Big Al Clopine, CPA debate, you’re in luck today on Your Money, Your Wealth® podcast 475, as they disagree on assumptions when it comes to retirement planning. The EASIretirement.com calculator says Chuck in South Carolina could convert even more to Roth, and the fellas spitball on the pros and cons. Plus, what should Chuck’s asset allocation be for his daughters, and how should Scott in Kansas City’s parents allocate their assets? Can Rothaholic undo his Roth conversion? Brian Fantana and his wife are in their 30s and want to retire at 60. Are they on track? Ricky in Alabama wants to avoid Medicare’s IRMAA, or income related monthly adjustment amount. Should he spend from his IRA or from his Roth? Daniel in Whittier wants to know what exactly counts for IRMAA income, anyway? And finally, Elisa in Fremont wants to know, with the new SECURE Act 2.0 rules, when can you transfer 529 college savings funds to Roth? Access this week's free financial resources and the episode transcript in the podcast show notes, and Ask Joe & Big Al On Air for your Retirement Spitball Analysis, at https://bit.ly/ymyw-475

Timestamps:

- 00:00 - Intro

- 01:07 - Will Our Withdrawal Rate Be Too High If We Retire in 3 Years? (Duke and Daisy, Charlotte, NC)

- 10:50 - Withdrawal Strategy Guide

- Retirement calculator

- 11:28 - EASIretirement.com Says I Should Convert More to Roth. Asset Allocation for Daughters? (Chuck, SC)

- 22:13 - Can I Undo My Roth Conversion? (Roth Aholic)

- 27:55 - In Our 30s, Want to Retire at 60. How Are We Doing? (Brian Fantana, WA)

- 30:36 - What's the Right Asset Allocation for Aging Parents? (Scott, Kansas City, MO)

- 32:00 - Free financial resources:

- 32:51 - IRA vs. Roth for Living Expenses? (Ricky, Birmingham, AL)

- 35:50 - What Counts for Medicare IRMAA? (Daniel, Whittier, CA)

- 39:49 - SECURE Act 2.0: When Can We Transfer 529 College Savings to Roth? (Elisa, Fremont)

- 44:44 - The Derails

From The Podcast

Your Money, Your Wealth

A "Top 10 Personal Finance Podcast" and "Top 12 Retirement Podcast" (US News & World Report, 2023). One of the "10 Best Personal Finance YouTube Channels" (CardRates, 2023). “Best Retirement Podcast With Humor” (FIPhysician, 2020, 2021, 2022, 2023). Learn strategies that can help you retire successfully. Financial advisor Joe Anderson, CFP® and certified public accountant Big Al Clopine, CPA are making fun out of finance as they answer your money questions and spitball on your 401k, IRA, Roth conversions and backdoor Roth IRA, how to pay less taxes, asset allocation, stocks and bonds, real estate, and other investments, Social Security benefits, capital gains tax, 1031 exchange, early retirement, expenses and withdrawals, and more money and wealth management strategies. YMYW is retirement planning, investing, and tax reduction made fun, presented by Pure Financial Advisors - a fee-only financial planning firm. Pure Financial adheres to the fiduciary standard of care, in which we are required by law to act in the best interest of our clients at all times. Access free financial resources and episode transcripts, Ask Joe & Big Al On Air to get your Retirement Plan Spitball Analysis: http://YourMoneyYourWealth.comJoin Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

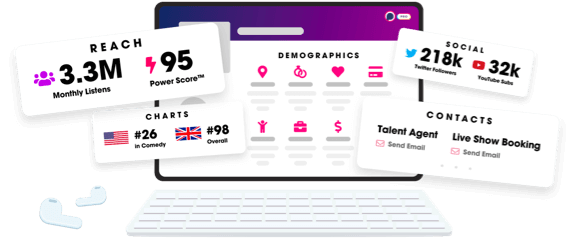

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us