Buying a company is one of the most expensive purchases possible. Investment bankers facilitate the buying and selling of companies and related financing. This episode focuses on the process of advising companies and investment firms to help the buying go smoothly.

Doug Lovette is the founder and Managing Director of Third Coast Capital Advisors, a firm that helps private equity groups and companies develop a strategy to grow by buying other companies. Once the strategy is developed, Doug and his team find companies to buy, secure the interest of business owners and manage all sides throughout the process.

This episode is relevant to anyone looking to buy a company, sell their family business or manage a very important relationship.

Third Coast Capital Advisors: https://www.thirdcoastca.com/team

Find Justin on Twitter: https://twitter.com/justinpfortier

Jargon

- Middle Market = companies between roughly $50M-1B in revenue

- Sell-side = activities related to selling companies, shares in companies or debt

- Buy-side = activities related to buying companies, shares in companies or debt

- Private Equity - investment groups that own private companies (not trading on the stock market) and assets

- M&A = mergers and acquisitions

- Merger = joining two companies

- Acquisition = buying a company

Related Videos

- Wharton panel on growth through acquisition: https://youtu.be/p0Bx6UtherQ

- Talk on managing client relationships by Goldman Sachs Partner Jim Donovan: https://youtu.be/z8kqCIxXTEw

---

Send in a voice message: https://podcasters.spotify.com/pod/show/toolkit/message

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

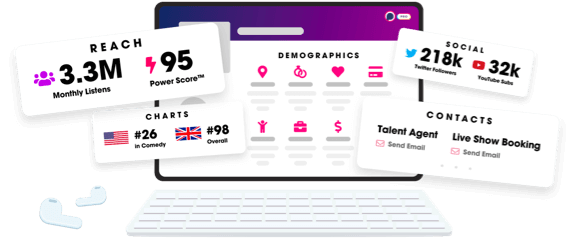

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us