If you're feeling the burden of unexpected property tax increases, then you are not alone! Many homeowners face the surprise of hefty tax bills that skyrocket their monthly expenses, especially around tax season. It's a common story, but understanding property tax regulations can prevent this from happening to you.

In this episode of the Texas Real Estate & Finance Podcast, Dr. Blake Bennett, an associate professor and economist at Texas A&M University's AgriLife Extension, shares valuable insights into the complexities of property taxes in Texas. Dr. Bennett's personal experience of being caught off guard by a substantial tax increase in the second year of homeownership highlights the importance of understanding property tax implications for first-time homebuyers. He emphasizes the necessity for proactive financial planning to prepare for potential spikes in property taxes and provides practical advice on navigating the intricacies of the tax system. His expertise sheds light on the impact of new exemptions, the dynamics of the real estate market, and the implications for homeowners, lending, and local communities. If you're a first-time homebuyer seeking to grasp the nuances of property taxes and make informed financial decisions, Dr. Bennett's insights and practical advice make this episode a must-listen.

Key Takeaways:

1. Understanding Texas Property Taxes:

Delving into the complexities of Texas property taxes can uncover significant savings opportunities for homeowners and realtors. This episode with Dr. Blake Bennett offers a comprehensive overview, highlighting the importance of being proactive about tax assessments and exemptions. Learn how property values are determined and the critical deadlines to keep in mind for appeals.

2. The Power of Homestead Exemptions:

Homestead exemptions not only reduce the taxable value of your home but also play a pivotal role in managing your property taxes effectively. Dr. Bennett explains the nuances of these exemptions, including who qualifies, how to apply, and the long-term benefits they offer, especially for those over 65 or with disabilities.

3. Challenging Your Property Valuation:

Many homeowners accept their property tax assessments without question. Yet, as Dr. Bennett outlines, challenging your valuation can lead to significant savings. This episode provides a step-by-step guide on preparing for your appeal, what evidence to gather, and how to present your case to the appraisal review board.

4. Over-65 Tax Freeze and Transfers:

A crucial benefit for Texas seniors is the over-65 tax freeze, which locks in the property tax amount, preventing increases as property values rise. Dr. Bennett discusses how to apply this freeze and the potential to transfer a percentage of your tax savings when moving to a new residence within Texas, underscoring a strategic approach to retirement planning.

5. Legislative Changes Impacting Property Taxes:

Recent legislative reforms in Texas have introduced changes to property tax laws, affecting homeowners and the real estate market at large. This episode covers the most significant reforms, how they impact your tax bill, and what to anticipate in future legislative sessions. Dr. Bennett emphasizes the importance of staying informed to navigate these changes effectively.

Time Stamped Summary:

00:00 - 02:00 Introduction to the episode with Mike Mills, highlighting the focus on Texas Property Taxes and the challenges homeowners face during tax season.

02:01 - 04:00 Introduction of Dr. Blake Bennett, an associate professor and economist at Texas A&M, with a brief overview of his expertise in Texas property taxes.

04:01 - 06:00 Discussion begins on the complexities of Texas property taxes and the common misconceptions homeowners and realtors...

From The Podcast

The Texas Real Estate & Finance Podcast with Mike Mills

Dive deep into the heart of Texas Real Estate with Mike Mills, your dedicated guide through the intricate world of home loans and beyond. The Texas Real Estate and Finance Podcast isn't just another industry show—it's an exploration of opportunities, a masterclass from industry titans, and a beacon for those aiming for the pinnacle of success.Whether you're a seasoned professional or a curious newcomer, Mike brings to the table not only his expertise as a home loan professional but also heart-pounding conversations with top experts and leaders from the realms of Real Estate, mortgage, finance, and other real estate-centric sectors. Our promise? No fluff, just smart, actionable advice distilled from the experiences of those who have carved niches and built legacies.Every episode is a journey – a step towards achieving your potential, realizing your goals, and making informed decisions in the world of real estate and finance.Are you ready to redefine success, shatter your ceilings, and journey through the vast landscapes of opportunity? Join Mike and his esteemed guests and step into a realm of inspiration, motivation, and success. Your potential awaits, and together, we'll help you seize it. Subscribe now!Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

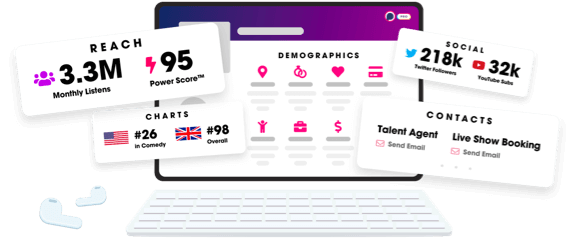

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us