Episodes of The Alternative Investor

Mark All

Search Episodes...

Today is an incredibly big day! Grayson may be closing on a huge deal tonight. It’s been a long time coming but it’s finally happening! He quit his last job about 3+ years ago and since then he’s been looking to buy a business and has gone thro

Today is an incredibly big day! Grayson may be closing on a huge deal tonight. It’s been a long time coming but it’s finally happening! He quit his last job about 3+ years ago and since then he’s been looking to buy a business and has gone thro

et’s say you find yourself in the fortunate position to have a wonderful asset that you’ve operated for a number of years — whether it’s real estate or an operating business — and you’re ready to sell it. And now, you’re faced with the decision

et’s say you find yourself in the fortunate position to have a wonderful asset that you’ve operated for a number of years — whether it’s real estate or an operating business — and you’re ready to sell it. And now, you’re faced with the decision

After 2 ½ years of looking for a software business to buy with my partner, I think we’re finally getting towards the end! And at the end of the due diligence process when you’re going to buy a company… you’ve got to sign a purchase agreement. T

After 2 ½ years of looking for a software business to buy with my partner, I think we’re finally getting towards the end! And at the end of the due diligence process when you’re going to buy a company… you’ve got to sign a purchase agreement. T

Today is going to be our all-encompassing, definitive episode all about on cap rates! What are they? How they are used? What’s the whole deal here? Tune in to find out!We discuss how they relate to interest rates, what they indicate, what they’

Today is going to be our all-encompassing, definitive episode all about on cap rates! What are they? How they are used? What’s the whole deal here? Tune in to find out!We discuss how they relate to interest rates, what they indicate, what they’

In this episode we’re going to be talking about investor relations — i.e. staying in touch with your investors and maintaining good relationships with them. Investors are people too, y’know! Just like your friends or spouse, they want to be kep

In this episode we’re going to be talking about investor relations — i.e. staying in touch with your investors and maintaining good relationships with them. Investors are people too, y’know! Just like your friends or spouse, they want to be kep

Today’s episode is all about taxes! Specifically, we’re going to be talking about K-1s. A K-1 is a tax form that you get from private investment (typically an LLC.) on an investment you’ve made. This is the tax form you’re going to get yearly f

Today’s episode is all about taxes! Specifically, we’re going to be talking about K-1s. A K-1 is a tax form that you get from private investment (typically an LLC.) on an investment you’ve made. This is the tax form you’re going to get yearly f

Productivity and how you get things done on a day-to-day basis is an ever-present issue for most everyone — including those in investing and alternative investing. There’s lots to do on a daily basis and you’ve got lots to juggle, so we want to

Productivity and how you get things done on a day-to-day basis is an ever-present issue for most everyone — including those in investing and alternative investing. There’s lots to do on a daily basis and you’ve got lots to juggle, so we want to

We’ve talked about finding deals, sourcing deals, putting a pitch deck together, raising money, and all that stuff — but we haven’t yet talked about how to go about raising debt for a real estate project.So today, we’re going to outline how to

We’ve talked about finding deals, sourcing deals, putting a pitch deck together, raising money, and all that stuff — but we haven’t yet talked about how to go about raising debt for a real estate project.So today, we’re going to outline how to

We’re getting technical today — so fasten your seatbelts, buckle up, take an extra sip of coffee and get ready for today’s show. We’re going to be diving into the topic of the three most important investment metric:; NPV (Net Present Value), IR

We’re getting technical today — so fasten your seatbelts, buckle up, take an extra sip of coffee and get ready for today’s show. We’re going to be diving into the topic of the three most important investment metric:; NPV (Net Present Value), IR

We’ve talked about sourcing and analyzing deals — but, we’ve yet to really get into the details of what goes into the pitch deck. The pitch deck is the document you’re going to send out to your investors to let them know about the deal, market

We’ve talked about sourcing and analyzing deals — but, we’ve yet to really get into the details of what goes into the pitch deck. The pitch deck is the document you’re going to send out to your investors to let them know about the deal, market

This week on the show, we’ve invite on a real estate expert: Moses Kagan! Moses is a partner of Adaptive Realty — a property management company in Los Angeles.Adaptive Realty has a unique strategy with apartment buildings; instead of simply buy

This week on the show, we’ve invite on a real estate expert: Moses Kagan! Moses is a partner of Adaptive Realty — a property management company in Los Angeles.Adaptive Realty has a unique strategy with apartment buildings; instead of simply buy

We’ve spent a lot of time on this podcast telling you how to find alternative investments — how to buy them, how to raise money for them, and more — but we haven’t talked a lot about what to do after you close. It’s really no exaggeration to sa

We’ve spent a lot of time on this podcast telling you how to find alternative investments — how to buy them, how to raise money for them, and more — but we haven’t talked a lot about what to do after you close. It’s really no exaggeration to sa

Just as this title says, we talk to guy who bought a business with an SBA loan! Nick Haschka is an entrepreneur and investor who lives in the San Francisco Bay Area, with his wife and two kids. He owns a small business called The Wright Gardner

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

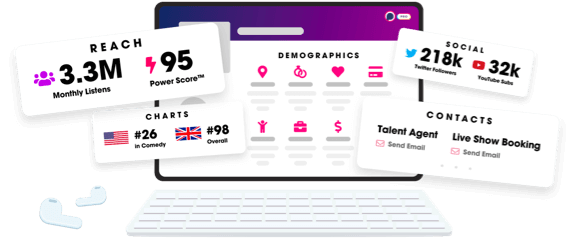

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us