Portfolios looking to make a real-world impact are increasingly considering real assets as part of their investment strategies.

With a trillion-dollar investment gap in our global infrastructure, this seems like a smart move. Real asset investing is not only driving progress worldwide, it’s also a smart long-term investment to secure our planet’s future.

But some may ask… what is the real extent of impact that real assets can generate? In this episode, we’re going to find out.

My guest is Anish Majmudar, the Head of Real Assets at M&G plc whose team focuses on investments in infrastructure, agriculture, and nature-based solutions. He studied economics at University College London and entered the world of finance and asset management in 2012 thanks to the graduate program at M&G.

Anish is here to share his remarkable insights on overseeing a vast portfolio that amounts to nearly $400 billion in assets across public and private markets.

His curiosity for alternative assets ultimately led to a crucial role in growing Prudential Assurance Company’s real assets portfolio division.

In this episode, Anish and I lay out all the opportunities and challenges within the real asset impact investing space, an area that M&G is opening up for a broader range of investors, having previously been the preserve of large institutional pools of capital. These investments aim to bridge the massive infrastructure spending gap with sustainable solutions, focusing on energy transition, responsible consumption and production, and social and economic inclusion.

We also discuss how this strategic approach is about much more than just capital investment for returns; it's about leveraging private capital and M&G’s expertise to create clean energy, improve biodiversity, and open doors for underserved communities, thereby driving decarbonization and advancing global sustainability.

Tune in to gain a better understanding of the deep impact that strategic investments in real assets can bring to our world.

—

Show notes

—

About the SRI 360° Podcast: The SRI 360° Podcast is focused exclusively on sustainable & responsible investing. In each episode, I interview a world-class investor who is an accomplished practitioner from all asset classes.

—

Connect with SRI360°:

Sign up for the free weekly email update.

Visit the SRI360° PODCAST.

Visit the SRI360° WEBSITE.

Follow SRI360° on X.

Follow SRI360° on FACEBOOK.

—

Key Takeaways

Meet Anish Majmudar & his start in asset management (02:58)

An overview of M&G plc & Anish’s focus on real asset impact investing (16:45)

Zoning in on M&G’s real asset impact fund (21:53)

M&G’s focus on energy transition, responsible consumption, & social inclusion projects (30:35)

How M&G identifies investment targets, impact washing, & investment exits (46:04)

Measuring impact & examples of M&G’s investment methodology (56:10)

Carbon and biodiversity credits & their competitive edge in real asset investing (01:06:35)

Rapid fire questions (01:11:50)

—

Additional Resources

Connect with Anish on LinkedIn.

Learn more about M&G plc here.

From The Podcast

SRI360 | Socially Responsible Investing, ESG, Impact Investing, Sustainable Investing

The SRI360 Podcast is focused exclusively on Socially Responsible, ESG, Impact, Sustainable & Responsible investing. To learn more, visit SRI360.com. Each episode presents an interview with a world-class investor who is an accomplished practitioner from different asset classes in lively, wide-ranging, long-format discussions. In each interview, we try to cover everything from each investor's early personal journey—and what motivated and attracted them to commit their life energy to SRI—to insights on how they developed and executed their investment strategies, what challenges they face today and much more. The conversations usually last between one to two hours—and occasionally even longer. So, each episode is a chance to go way below the surface with these impressive people and gain additional insights and useful lessons from world-class investors. Past guests include Jenn Pryce, Calvert Impact Capital; Alina Donets, LO Assets Managers; Matt Patsky, Trillium Investment Management; Jed Emerson, Tiedemann Advisors; Eric Rice, BlackRock; Simon Bond Columbia Threadneedle Asset Management; and more.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

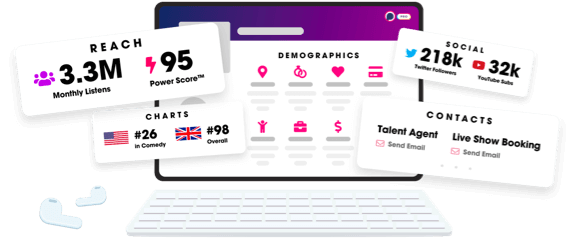

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us