Are you a solo entrepreneur puzzled by the myriad of retirement planning options?

Mike Jesowshek welcomes back Matt Ruttenberg to discuss retirement plan options for solo entrepreneurs without employees. They highlight various plans like IRAs, SIMPLE IRAs, SEP IRAs, and solo 401(k)s, emphasizing the importance of starting with the desired savings amount to determine the most suitable plan. The episode covers the contribution limits, the benefits of each plan type, and the financial implications of choosing one plan over another, particularly in terms of tax deductions and maximizing retirement savings.

Discover how choosing the right plan can maximize your savings and secure your financial future by tuning in!

[00:00 - 05:48] Exploring Basic Retirement Plan Options, SEP IRAs, and Solo 401(k)s

- Mike introduces the topic of retirement plans for solo entrepreneurs.

- Matt discusses simple retirement options like individual IRAs and SIMPLE IRAs, highlighting their benefits and contribution limits.

- He elaborates on the higher contribution limits of SEP IRAs and the advantages of solo 401(k)s, including their structure and potential for higher savings.

[05:48 - 15:22] Comparison of SEP IRA and Solo 401(k) Contributions and Decision-Making in Retirement Planning

- Matt and Mike share a detailed explanation of how contribution limits are calculated based on business type and income.

- They discuss the extra benefits of solo 401(k)s, such as catch-up contributions for those over 50.

- Choosing the right retirement plan based on the amount one wants to save simplifies the decision-making process.

[15:22 - 20:05] Closing and Resource Mention

Direct Quote:

"So you might have a couple hundred dollars of fees, but you are netting a substantial amount more, going into that solo than you are with the SEP IRA." - Matt Ruttenberg

Connect with Matt Ruttenberg!

LinkedIn: https://www.linkedin.com/in/mattruttenberg/

______

Podcast Host: Mike Jesowshek, CPA - Founder and Host of Small Business Tax Savings Podcast

Join TaxElm: https://taxelm.com/

IncSight Packages (Full-Service): https://incsight.net/pricing/

Book an Initial Consultation (IncSight): https://app.simplymeet.me/o/incsight/sale

-------

Podcast Website: https://www.TaxSavingsPodcast.com

Facebook Group: https://www.facebook.com/groups/taxsavings/

YouTube: https://www.youtube.com/@TaxSavings

From The Podcast

Small Business Tax Savings Podcast

The Small Business Tax Savings Podcast is designed specifically for small business owners. We focus on tax savings and ways to have a financially sound back bone to your small business. Our goal is to have you paying the least amount in taxes as legally possible.Hosted by by Mike Jesowshek, CPA, this is a quick hitting podcast aimed to get you important information without all the fluff. You can find episodes, blog posts, information on our software TaxElm and more on our website: www.TaxSavingsPodcast.comJoin Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

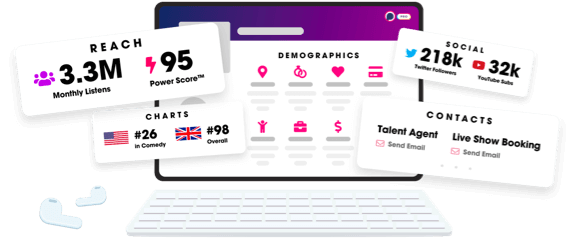

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us