Episode Transcript

Transcripts are displayed as originally observed. Some content, including advertisements may have changed.

Use Ctrl + F to search

0:00

Episode 433, "The Mystery of the Weekly Claims Wire.

0:06

What Are Plan Sponsors Actually Paying For Each Week?"

0:10

Today, I speak with Justin Leader.

0:21

American Healthcare Entrepreneurs and Executives You Want to Know Talking.

0:27

Relentlessly Seeking Value. On the show today, I am going to use the term TPA, Third Party Administrator, and

0:35

ASO, Administrative Services Only vendor, kind of interchangeably here, but these

0:40

are the entities that a plan sponsor, for example, a self insured employer is

0:45

a plan sponsor, but these plan sponsors will use to administer their plan.

0:50

And one of the things that TPAs and ASOs administer is this

0:55

so called weekly claims wire.

0:57

Every week, self-funded employers get a weekly claims run charge.

1:03

So they can pay expenses related to their plan in weekly increments.

1:08

The claims run usually comes with a register or an invoice.

1:12

This invoice might be just kind of a total.

1:14

Hey plan, pay this amount. Or there might be a breakdown, like here's your medical claims.

1:19

And here's your pharmacy claims. Maybe there's another level down from that of detail, if the plan or

1:25

their advisor is sophisticated enough and or concerned enough about the

1:28

fiduciary risk to dig in hard about what the charges are actually for.

1:34

I was talking about this topic earlier with Dana Erdfarb, who happens to be

1:38

executive director of HR at a large financial services organization,

1:43

Dana, I'm definitely going to credit for inspiring this conversation that

1:47

I'm having today with Justin Leader. Dana was the first one to really bring to my attention just the

1:53

level of hidden fees that are buried many times in these claims wires.

1:59

Because when I say buried in the claims wire, I mean not charged

2:04

for via an administrative invoice.

2:07

These hidden fees are also not called out in the ASO finance

2:11

exhibit in the contract, by the way.

2:13

So yeah, hidden. I don't know if you have to hide your charges.

2:17

In my mind, that's a pretty big tell that your charges are worth hiding.

2:21

Now, the one thing I will point out is that just because the charges

2:24

are worth hiding doesn't necessarily mean that the services those

2:28

charges are for are unwarranted.

2:32

Some of these services are actually pretty worthwhile to do.

2:35

There's just a really big difference from a plan sponsor knowingly contracting

2:40

at a known rate with a third party to do something versus paying for

2:45

a service knowingly or unknowingly via fees hidden in a claims wire,

2:49

wherein the amount paid is not in the control of the one paying the bill.

2:53

Anyway, I was talking about all of this earlier, as I mentioned with Dana Erdfarb.

2:58

That conversation was exactly the framework that I needed to snag Justin

3:02

Leader, my guest today, to come on the pod and really dig into the detail level

3:06

of what's going on with this claims wire. So today we're going to talk about the five fees that tend to

3:11

be tucked into many claims wires.

3:14

We also talk about one bonus, not sure if it's a fee, one bonus way that plan

3:19

sponsors give money to vendors in ways the plan sponsor might be unaware of.

3:25

Here are the five hidden fees that we talk about at length in the show

3:29

today, and then I'll cover the bonus. First hidden fee is the shared savings fees.

3:34

This is where a member of a plan goes out of network and the TPA/ASO

3:40

goes and negotiates a discount from the out of network provider

3:44

and then shares the savings.

3:47

Get it? Shared savings. This category also might include BlueCard access fees, which we talk about in the

3:53

show, but there also could be overpayment recoupment fees lumped in here.

3:57

This is where the TPA messes up, overpays, and then charges the plan sponsor a

4:03

percentage of the money they just got back when they corrected their own mistake.

4:07

I'm just going to pause here while everyone contemplates how we've all

4:11

gone so wrong in life to not have figured out a way to charge others

4:14

when we correct our own mistakes. Second, hidden fee, prior auth fees, lots to unpack with this

4:21

one, which Justin does in the pod.

4:24

Number three are prepayment integrity fees.

4:28

So this is evaluation of the claim before it's being paid.

4:31

Listen to the show for how this may or may not differ from what the

4:35

TPA/ASO is supposed to be doing, i.e.

4:38

it's the TPA that's supposed to be, yeah, right, adjudicating and paying claims.

4:44

Pay and chase fees, this is the fourth kind of fee.

4:46

This is where a bill was paid wrong, and it's not immediately

4:51

the TPA/ASO's mistake.

4:54

This is where something like a provider double billed or overcharged or something.

5:00

And the TPA/ASO later figures this out and then chases the pay to get the money back.

5:08

And then five TPA claims review fees, sort of self explanatory, but also not.

5:13

Again, please listen to the show for more. When I've been talking about all of this with Dana Erdfarb, as I mentioned earlier,

5:19

just about this whole thing, she said something that Justin Leader echoes today.

5:22

Many of these fees are structured as a percentage of savings.

5:26

This is challenging for a plan sponsor because the savings is

5:30

vendor reported and not validated. But it also means that if the savings increase annually with trend, as they

5:37

generally speaking do, then the fees will increase with that trend as well.

5:41

And that is something to keep in mind. Okay, so here's the bonus thing that didn't get a number in the show

5:47

today, but it is certainly a way that plan sponsors pay money to vendors.

5:51

And this is medical claims spread pricing.

5:55

This is buried in the claims wire and inside the dollar amounts

5:58

the plan sponsor thinks they are paying a provider for a service.

6:02

It turns out, but it can turn out, that the amount the plan sponsor

6:06

is paying is more than the check that's being written to the provider

6:10

for the service being delivered. Or the amount the plan sponsor is paying the provider for a service.

6:16

Is more than for simply that service that has been rendered right?

6:21

The plan sponsor is paying the provider for other stuff as well, as is alleged

6:25

in the DOL vs BCBS of Michigan lawsuit, which Justin brings up in the show today.

6:31

It drives me nuts, honestly, when there are people who tout their transparency.

6:37

But then it turns out if the equation is A plus B equals C, only like

6:42

one of the numbers is transparent. Sorry, functionally, that doesn't count as transparency, except in marketing copy.

6:50

As mentioned a myriad of times already, my guest today is Justin Leader, who

6:55

is president and CEO of BenefitsDNA.

6:58

Justin works with plan sponsors, both commercial plans as well as Taft

7:01

Hartley plans across the United States. Before we kick into the show today, I just want to thank ByThe49ers for

7:06

the really nice review on iTunes.

7:09

ByThe49ers calls Relentless Health Value a leading voice in healthcare and says he

7:15

or she always leaves with intrigue, a new idea or a new approach to problem solving.

7:20

Really appreciate that. That is certainly one of our goals around here.

7:24

So thank you so much. My name is Stacey Richter.

7:26

This podcast is sponsored by Aventria Health Group.

7:29

Oh, also, please subscribe to the weekly email that goes out.

7:33

You can do that by going over to our website and signing up.

7:37

There are a lot of advantages to doing so, which I've talked about before, so I'm not

7:41

going to do so again, but it is a great way to make sure that if you're a member

7:45

of the Relentless Health Value Tribe, you are aware of the current goings on.

7:50

Justin Leader, welcome to Relentless Health Value.

7:52

Stacey Richter, thank you for having me.

7:55

Let's talk about this claims wire here. First of all, how is this claims wire typically explained?

8:02

So if I'm a typical self insured plans sponsor, someone's probably

8:07

going to tell me that this claims wire is going to happen.

8:09

Maybe it's the broker that's explaining on behalf of the ASO, but how does that

8:16

typical explanation go down in short?

8:18

Typically the explanation is you're going to go from paying monthly

8:23

claims or invoices to paying a weekly claims run, and there'll be some

8:26

fluctuation, but we can budget for that.

8:29

Now I'm role playing the plan sponsor.

8:31

So you're just gonna draw from my bank account.

8:35

What happens here? Each week we're going to hit you with a claims register.

8:38

You're going to take a look at that and then you're going to approve those claims to be paid.

8:43

Some weeks they'll be low, some weeks they'll be high.

8:45

So claims, I'm told I'm paying claims?

8:48

You're paying claims. You're paying medical and prescription claims.

8:52

Typically on the same register. This is going to be really good for you, Mr.

8:56

and Mrs. Plan Sponsor, because you'll be able to understand what's going on within your

9:01

plan on a week to week basis by the invoice amount that you're going to pay.

9:06

So, on my invoice, if I'm looking at a sample of one of

9:09

these, what do I actually see? What is on there?

9:12

A list of all of my claimants with their claims and all the drugs I paid?

9:16

Stacey, you're asking a lot of questions. It really depends.

9:20

It depends on the administrator. You may get very, very basic information like, here's your

9:26

medical claims for the week. Here's your Rx claims for the week.

9:29

Sometimes, you might get a little bit more detail.

9:33

You might get claimant information, you might get maybe member ID, claim

9:38

number, date of service and paid amount. If you get a little bit better information, you're going to get the

9:43

type of service, provider information, the charged amount, the paid amount,

9:47

claim status, but ultimately it's up to you as the plan sponsor or

9:52

as the advisor in certain instances to push for that information.

9:55

This wire is an amount that is paid by the plan on a weekly basis.

10:01

Plans are told, okay, well, these are for your actual claims.

10:05

I mean, there's other payments that are going on, which are supposed to be, which

10:09

are for administrative stop loss, right?

10:11

Like, so I mean, there's other bills, which are happening, but

10:14

what this wire is supposed to be is to pay for actual claims.

10:18

Did I get that right? You got that. Absolutely correct.

10:21

I have to say, Justin, one of the reasons why I asked you to come on this podcast

10:26

and talk about this topic is because I have gotten so many requests from plan

10:33

sponsors who say to me, I'm getting this invoice and it's got to your exact point

10:41

some level of detail, but I don't know much and I'm feeling like I actually

10:45

keep asking, what am I paying for here?

10:48

And bottom-line, I can't figure it out.

10:51

It feels like there's other stuff that's going on here.

10:53

Someone will allude to something else that I'm paying for, but I

10:56

just cannot get any details here.

11:00

And I think that's part of the major issue. Employers go to self-funding because they want to feel like they're more

11:05

in control They want to be able to glean insights and look at data.

11:10

However, by virtue of moving self-funded, it doesn't mean that you're going to have

11:14

all this unencumbered access to data.

11:17

I guess keep in mind too, like the whole point of this or self-funding in general

11:23

is to be able to take actionable insights. So that's a big topic of discussion in itself.

11:27

But, there's a lot of stuff that's buried in the claim that can go on.

11:31

And that's why it's so, so vital to understand what

11:34

the heck we are paying for. This is an opportunity really, this claims wire, because you don't have

11:41

to wait till the end of the year to figure out that a lot of money got

11:44

spent that now you can do nothing about.

11:47

If there is a right sized amount of data that is in the claims wire that comes

11:51

across just even relative to the claims, irrespective of everything else, then this

11:56

is actionable information that this kind of black box starts to become more clear.

12:03

And if it's a black box, the solution is also a black box,

12:07

right, as Rick Renard has said.

12:09

And the thing is the black box is sometimes buried in the middle of the

12:13

Pacific Ocean and you have to really dig down to get to that level of detail.

12:17

But on the surface, the beauty of it is you can start to take some action.

12:21

The unfortunate thing is not all claims runs are created equal.

12:24

Not all claims runs provide the level of detail that you want regarding what

12:29

should be common, like the example that I just gave, but even more specifically,

12:33

some of the buried fees that you have no idea are being incurred within the plan.

12:38

All right, so let's talk about these buried fees.

12:40

Exactly what are all of the things?

12:43

There are five things. Shared savings fees.

12:47

We have prior authorization fees. We have prepayment integrity.

12:52

We have pay and chase. Then we have the bare bones basic, which is the TPA that's doing the adjudication.

12:58

Okay, so taking it from the top. Let's talk about shared savings fees.

13:02

So first of all, what is a shared savings fee?

13:06

Shared savings fee is a fee that is taken by the administrator, or another

13:10

point solution for helping to reduce that charge within the claims run.

13:17

So it could be an out of network provider fee, that's typically the most common.

13:22

One of my members goes to an out of network ER or something, right,

13:29

or just an out of network place. I pay some exorbitant amount.

13:35

The TPA goes to that out of network place, negotiates a 50 percent

13:41

discount, and then gets a percentage of whatever the new discounted rate was.

13:47

And it could be even something as common as BlueCard access fees, right?

13:53

You're going into another Blue's network utilizing a Blue and you're

13:56

going to get pinged for a fee for entering into another Blue territory.

14:00

Basically, I have a Blue's plan if I'm, if I'm a member here.

14:04

And my plan has a contract with my 10 local hospitals or whatever, but a

14:10

member goes to another hospital, which is covered by another Blue's contract,

14:14

which is outside my technical network.

14:17

Is that what you mean? You got it, not all Blues are created equal, they do compete with one

14:22

another, and while they are all part of the same Blue, I'm doing bunny

14:25

ears, program, there are fees to enter into other Blue territories.

14:31

That sounds great. Why wouldn't I want my plan TPA, ASO, why wouldn't I want

14:37

them to go get me a discount?

14:39

Yeah, and regardless if it's just a standard out of network negotiation

14:43

fee that's collected, I say standard.

14:46

It's important for you from a feesharing perspective to understand

14:49

exactly what your contract says. And it could be a percentage of savings over the allowed amount.

14:54

It could be a percentage of savings over the billed amount.

14:57

It really depends. And sometimes the details are really, really vague.

15:02

Example, I read a contract not too long ago where it just said the administrator

15:07

reserves a right to receive a percentage of savings for any out of network service.

15:12

Okay, percent of savings, there's no percent there, and savings based on what?

15:16

Based on what reasonable and customary is, based on the allowed amount?

15:21

So there's no detail. Request it. I've also seen as high as 50 percent of savings fees for these claims.

15:28

You start thinking about it to your exact point.

15:31

First of all, what's the price that was charged?

15:34

The chargemaster rate, which is generally speaking this rate that, you

15:38

know, even hospitals always say their excuse in a way or rationale for having

15:42

a really high chargemaster is like, oh, no one actually pays that rate.

15:47

Okay. So they're using a chargemaster rate to determine what the top-line price is.

15:53

And then the bottom-line price, I guess, is the in network, right?

15:56

But anyway, you can see that you'd have this huge potential savings.

16:02

And then if someone's taking 50 percent of that, I could see that,

16:05

that would add up to a lot of money. A ton in certain instances, and maybe it's a small percentage of your overall spend,

16:11

but those fees, depending on how large of a claim it is, can be quite egregious

16:16

if there's no cap on what they're taking.

16:19

So, it's kind of absurd, really. I mean, changing the rate from bill charges to usual customary or some

16:25

RBP method of repricing shouldn't cost 20 to 30 percent of the difference.

16:30

Ultimately, it would be nice to see it as a fee for service, but

16:34

keeping in mind most administrators year after year, they're in a

16:38

battle to keep their fixed fees low.

16:41

That's just the nature of how they're built and how the

16:44

marketplace is positioning. So what I'm understanding you say is that there's a fierce competition

16:49

amongst advisors, TPAs, like this just this whole cohort and plan sponsors

16:54

are shopping based on fixed fees. So if somebody has a cheaper fixed fee, they're like, oh,

16:58

I want to go with that one. And then it's like squeezing a balloon.

17:01

It is, it is, and I gotta give props to Cora Opsahl.

17:04

I know she's been on your podcast a number of times.

17:07

She made this very brilliant statement.

17:10

Rates are important, but so are your rights, and your rights to be

17:13

able to understand what's going on. So let's look at a, you know, another fee, overpayment recovery.

17:19

We overpay a provider, and it's out mistake is the administrator, and now

17:25

we're gonna collect a fee for recoupment? That boggles my mind.

17:30

We're, we're gonna fix a mistake we made and then keep a

17:32

portion of that for ourselves.

17:35

So, they're almost always reported as claims cost.

17:39

But very clearly they're compensation, right?

17:42

That's another revenue source for the administrator.

17:45

So within this shared savings category, we may have also mixed up in here.

17:51

As you just said, TPA makes an error and then they're like, oh, I made a mistake.

17:57

They go and correct their mistake.

18:00

Get the money back that they overpaid and then charge the plan sponsor

18:05

to correct their own mistake. It's called an overpayment recoupment fee.

18:09

Now, there's a lot of rumors around the industry, and we'll

18:12

talk about some of those. You have to separate fact from fiction.

18:15

But it's rumored that there are algorithms in the old COBOL processing

18:20

for the adjudication software that every so often it'll purposely

18:24

overpay to collect a fee back. That could be just completely malarkey, but ultimately it's one of those other

18:31

areas that there are fees being collected.

18:34

But I could see why rumors such as this begin, because if I'm a TPA and

18:41

I am just trying to figure out how to make more money, my incentive is very

18:45

perverse and it's to make mistakes. Like, I get paid more if I make a mistake than if I don't.

18:50

Isn't that an awesome job to have? Like, you get paid more for making more mistakes.

18:55

Alright, so in our shared savings category here, we've got the getting money back

19:00

if one of my members goes out of network.

19:03

The other bit of this also could be if I make a mistake as a

19:07

TPA, correcting my own mistake.

19:10

Is there anything else that you would lump into the shared savings?

19:14

I think those are really the big ones, correcting out of network, you know,

19:17

different BlueCard access fees, fees on the backs of the administrator themselves.

19:22

I think one of the big points that you're making is that these tend to be

19:25

invisible, as are all of these categories.

19:28

In other words, I don't know that.

19:31

Lots of my members are going to this one particular hospital that

19:35

is charging some rate that my TPA is then going and negotiating down.

19:42

Like, I don't have any of this information.

19:44

As you said at the top of this conversation, I'm just getting one number.

19:47

It's called medical claims. So, if you don't know something...

19:51

Well, and it's the cost of doing business.

19:54

They'll say they have various methodologies and ways our job is

19:59

to understand what those ways are and make sure that we're holding the

20:03

administrators accountable to provide fair fees for what we're, what we're buying.

20:08

The problem is it's so opaque.

20:10

It's tough for any plan sponsor to be able to approach the market and understand

20:14

truly what's going on within the data.

20:17

And it's an uphill battle and I've, I've fought it time and time again, sometimes

20:20

winning more often than not we lose, but we lose getting more information.

20:25

than what we started with. So to me, that's winning the battle to eventually win the war.

20:30

Which I think is maybe inspiring for those who are listening, who are getting

20:35

claims wires with like one or two numbers who have been fighting the good fight

20:39

and not winning relative to like what they're paying for on a weekly basis.

20:43

Stacey, those that set up auto pay for the weekly claims run and don't even

20:49

review them before the invoice is paid.

20:51

Ouch. All right. So the first charge that may get folded into this claims wire, we just

20:59

discussed these shared savings fees. The second one that you had mentioned is prior auth fees.

21:03

What's going on there? Paying fees for prior authorization.

21:07

It just makes me scratch my head because you as an administrator have a

21:12

responsibility to administer the plan the way the plan documents have been written.

21:17

You're essentially, are you charging a fee for doing your job?

21:21

That's the question. Yeah, so much to unpack here.

21:26

So the second thing that might be buried in this claims wire

21:29

are these prior auth fees. And I do feel like it's really important and you said this to mention

21:37

that on its face, ensuring that care is appropriate and evidence based.

21:44

That feels like something that actually could benefit a plan member to understand

21:48

that, wow, there's a genetic test that could determine if this drug with terrible

21:52

side effects that's really expensive is going to actually work for you or not.

21:56

And you didn't get that genetic test. There's certain things which definitely could be seen as a

22:01

member, a win win across the board.

22:04

On the other hand, we have what's going on now with prior auths, which is not that.

22:10

And if the plan sponsors are reimbursing a payer to be doing prior auth paperwork,

22:16

then what incentive really does the, I mean, let's make it as complicated as

22:20

possible because I'm making money here. Once again, it's additional compensation that probably isn't being

22:25

broken out on a line itemization. Especially if you're really compliant with the CAA rules, asking for a

22:31

408(b)(2) Fee Disclosure of all direct, indirect, and non-monetary compensation.

22:37

Good luck getting that identified as indirect compensation

22:40

that was earned on the plan. Yeah, and Al Lewis has talked about this quite a bit also, about actually MRI prior

22:47

auths, and what they basically found is that, The MRIs tended to be done anyway,

22:52

just in the next quarter or something.

22:55

So like you had all of this paperwork that was being done, such that

22:59

the plan could basically say, oh, I prevented however many MRIs and

23:03

look how much money you saved plan. But then those same MRIs transpired like the next quarter.

23:07

So it actually was just additional, it's a profit center.

23:11

You hit the nail on the head. So that's the second thing that, that could be included in the claims wire

23:16

that people should certainly be aware of.

23:18

And I just want to be fair to your exact point.

23:20

You said this, there is value here if it's done in a way that's a win win with

23:26

the plan sponsor and if those dollars are transparent, but the way it's

23:30

currently being done may not be a win win and it's very, very not transparent.

23:34

I would agree. Uh, okay. So the third thing, prepayment integrity, I think you said.

23:39

Yeah, so evaluation of the claim itself before it's paid.

23:47

So a lot of folks will say, well, is that different than what the TPA is doing?

23:53

The fact of the matter is the TPA in most instances, 85 percent of

23:57

the claims are auto adjudicated. So how much review is going into that live weekly run of claims?

24:04

I would argue it differs from administrator to administrator.

24:08

I would be concerned on how high the auto adjudication rate is for a lot

24:13

of these vendors that are out there. I would prefer to have better oversight at time of claim processing.

24:21

So, what does that look like?

24:24

Right now, I would say that there's not enough of this going on.

24:28

Technically, under the ERISA guidelines, to be prudent, loyal to the plan, you

24:32

have to understand what's going on within the claims themselves and also have

24:36

to understand to some level of detail exactly what it is that we're paying for.

24:41

So in this you might see things like upcoding, unbundling, a number of

24:45

issues that we'll talk about in the pay and chase model, but here we have

24:49

a great opportunity with technology and artificial intelligence to implement

24:54

a better, a better methodology of analyzing these claims at the

24:58

time that they're being processed. As opposed to some of the archaic technology that's being used

25:03

with the systems that are behind the scenes at the administrator.

25:07

It sounds like there's two ways a plan sponsor might get charged by

25:11

their administrator to process claims.

25:14

One of them is the administrative fee, which is, that's what it's supposed to

25:17

be used for, right, processing claims. But then there may be a second goings on, which the plan sponsor is paying

25:25

for in this category, this prepayment integrity, in which like they're doing

25:28

something else over and above just merely administering claims in order to

25:35

ensure that the claims paid are correct. Let me, let me lay this out to you.

25:39

Sometimes the carrier agrees in the provider contracts not

25:41

to review claims prepayment. So the errors are let through intentionally or unintentionally, if

25:46

you will, as none of the claims are reviewed in detail prior to payment.

25:50

Why catch it prepayment when you are compensated more to find it post-payment?

25:55

Yeah, so what we're talking about right now in this category, as we

25:59

just mentioned, is this prepayment and integrity, the administrator, what they're

26:04

doing is charging an over and above fee to ensure that the claims are accurate.

26:11

And this could be happening prior to the claim being paid, but it

26:14

would be considered not normal. Right.

26:17

So like maybe some are being, you get flagged for some reason and stuck

26:21

down the second shoot and looked at more carefully is that what do they

26:26

even explain that they're doing? It's very prudent if your administrator's not doing a good job on the front end,

26:33

it really pays dividends to ensure that you have some sort of vendor in

26:39

there that's aggressively demanding this information and requiring it

26:43

to be shared as set forth in the gag clause prohibitions under ERISA.

26:48

This is one of the, one of the five that I think it's okay to pay

26:51

more money for because it's needed.

26:53

Accuracy is needed earlier on in the adjudication process.

26:57

There's point solutions that have developed out there that allow for

27:01

increased oversight and understanding of what is happening with the

27:05

claim before it actually gets paid.

27:08

You're not going to see that in most administrators because they're

27:12

incentivized to have errors with some of these other fees that we talked about.

27:17

In most instances, the really good administrators out there tend to

27:22

lose a lot of business because if they're doing a better job on the

27:25

front end, they tend to cost more.

27:27

And this is just because of the whole squeezing the balloon thing.

27:30

If they're up front, there's just enough employers who don't really

27:34

understand that you're going to pay for it on the front end.

27:37

And if you don't pay for it on the front end, you're going to pay a lot on the back end.

27:41

So much on the back end. I'll use a good example.

27:44

We got a fund that's a multi-employer fund.

27:46

It was spending about $13 million annually Just by virtue of doing

27:51

a better job on the front end, we reduce that expense by $1.5 million.

27:56

Wow. I think it's becoming very clear to me just how much money is, is being

28:01

spent on that wire that doesn't, again, accrue to member health or

28:06

may not be a spend that has value.

28:09

If I'm going to put it that way. This is much like the ShamWow guy.

28:13

Oh wait, there's more. We can, if you want to, get into pay and chase.

28:16

Yeah. Let's talk about pay and chase. So this is our fourth category.

28:20

We've talked about shared savings. We've talked about prior auth fees.

28:23

We've talked about prepayment integrity.

28:26

This is number fourth, pay and chase. Pay and chase is not getting paid a shared savings fee if a patient goes

28:34

out of network and the administrator can negotiate some discount.

28:38

We already talked about that. This is also not getting back dollars that the administrator paid by mistake

28:44

and then fix their own mistake. That's also something else.

28:49

Pay and chase. There was dollars that were paid, which were deemed to be wrong.

28:52

So maybe it was the provider overcharged.

28:55

That's most of what's in this category.

28:57

And I, as the administrator, have realized that the provider sent

29:01

me a wrong bill that got paid. So now I'm going to go chase after those dollars and get them back.

29:06

Did I get that right? Correct, and maybe within the claims there's unbundling, there's

29:11

upcoding, maybe there are a number of issues, uh, that you find in

29:15

when you're comparing some of those claims to case management notes and

29:19

let me, let me add an asterisk here. Sometimes you're only looking at large claims, right?

29:23

So there are literally like thousands and thousands of claims that would fly under

29:28

the radar that may not get audited, that could have errors, that could add up.

29:32

It's just, it's, you have to be prudent.

29:34

Julie Selesnick was on this show a couple of weeks ago, and she's like, it is the

29:40

very definition of a fiduciary breach.

29:42

When you have the one auditing your claims, also the one who's doing the

29:47

claims, like, that is not prudent from a fiduciary standpoint, by any definition.

29:53

She is so right. You look at like the J&J lawsuit, that's a big consideration for everybody regarding

30:00

what they're doing within their plans. I had another Taft Hartley fund, wanted to do an audit.

30:07

They used the approved vendor to audit their claims.

30:10

The one that was approved by the network. Lo and behold, the auditor found around $21,000.

30:17

in errors that they got money back from the administrator.

30:22

Can you take a guess what the fee was for that audit?

30:25

$21,000 was overpaid vis a vis errors.

30:29

And you're asking me what the fee the auditor charged to find that 21k was.

30:35

Correct. It's $25,000.

30:37

Like, like, so you didn't even, you didn't even recoup enough money to

30:42

pay your own fee, which is ridiculous.

30:44

This is on millions and millions of dollars of claims.

30:48

So, we finally get the ability to do an audit with an independent party, right?

30:53

Somebody that we brought in. Same amount of claims, same issues.

30:58

And they come out with more than 20 times that in errors?

31:04

Come on, man. Are you kidding me? Yeah.

31:06

Well, I mean, you got the fox guard in the hen house.

31:10

I mean, honestly, like you're going to hire the same exact company that's

31:14

doing the work to audit their own work. In what world is that a good idea?

31:19

I talked to a plan not too long ago that has a couple hundred million in annual spend.

31:23

And I asked, like, who's advising you?

31:25

And they're like, my administrators, also my network,

31:29

which also is also my stop loss.

31:32

We also use their PBM and then our actuary and advisor is also a part of their team.

31:37

I don't mean to laugh. I'm sure it's very efficient.

31:40

I guess efficient to waste hundreds of millions of dollars.

31:43

That really segues into the TPA themselves and the TPAs and the

31:48

claim review that they're doing. That would be the the fifth part.

31:51

Okay, so right now we have segued, as you said, into number five,

31:57

which is our TPA claim review. What's, what's this?

32:00

Yeah, so this is just your basic administrator.

32:02

I mean, most administrators, and I'll quote a dear friend of mine,

32:06

Mark Davenport, he said, TPAs are kind of like khaki pants.

32:10

They're all pretty much the same, just a different shade of brown.

32:14

And he's right, all the claims have a network relationship.

32:18

Most of them are beholden to the network relationship, meaning that they're gonna

32:21

follow whatever the network rules are regarding what they're allowed to do with

32:25

the claims that they're adjudicating. Most of these administrators, as I said, are auto adjudicating claims.

32:32

85, 90 percent of claims that flow from the provider have to

32:36

visit auto adjudicated, handled by software, not by people.

32:41

The auto adjudication process, checks for eligibility, prior auths, coverage,

32:44

plan design, member liability. The problem is, is how accurate is that information that's just

32:50

hitting the software and paying? It's a good question.

32:52

It is a good question. Not many people know the answer to that question or are willing to

32:56

delve in to understand that with each of the administrators that they're

32:59

reviewing and potentially hiring.

33:01

You had alluded to when we were talking about our number three category,

33:04

which is the prepay integrity, that it's worth it to pay somebody.

33:08

Third party to do some due diligence here, TPAs are, you know, that's what

33:14

your administrative fee goes to paying to have these claims adjudicated,

33:18

but they may be doing a great job or they may be doing a really, really

33:22

bad job and you would never know it unless you have third party experts

33:28

with their eyes on what's going on.

33:32

100%. Here's a great quote from Karen Handorf that she said to me the other day.

33:36

She said, getting gag clauses out of your contracts is a useless exercise

33:40

if you don't look at the data to figure out how it is hurting, not just you, the

33:45

plan, but the plan participants as well.

33:47

You hire an administrator. They tell you they're going to do a great job.

33:51

Some of them might say, oh, we have a really, really high out adjudication rate

33:55

and we pay claims accurately and timely.

33:59

What does that really mean? Okay, you're paying them accurately in timing.

34:02

How do you define that? How do you define a clean claim?

34:05

How do you define the, the access rights that I have to be able

34:09

to review claims, whether it's a $20,000 claim or a $2 million claim.

34:14

And this is exactly also what any number of guests on this show have said.

34:19

Julie Selesnick, Dawn Cornelis was on the show.

34:22

You mentioned Dawn. It's not only getting the data, but it's also using it.

34:27

A hundred percent. You have to use it.

34:29

Data's data, so what? What are you going to do with it?

34:32

You know, there's that Jim Collins quote, you can't manage what you can't measure.

34:36

And the data enables measurement.

34:39

It's a marketing statement to say that I, if I'm a TPA, the front page

34:44

of my website, it's going to be all about how amazing I am at adjudicating

34:47

claims, but it's a marketing statement.

34:49

It is. You got to get the data to check.

34:51

There are dozens of TPAs out there that are involved with fully-funded,

34:56

level-funded, self-funded, they're involved with captains,

34:58

they're involved with consortiums. Complacency is not okay.

35:02

It's now against the law. I think people walk in with their sorcery.

35:07

I have this magic box of smoke and mirrors, and I will just feed

35:12

your claims in the one side, and I will get you 10 percent savings.

35:16

You know, like we had A. J. Loiacono on the show, and he said he was talking to some

35:21

broker and the broker said, A.

35:23

J., I can make the spreadsheet show anything I want.

35:26

And I think that's what we're talking about here. One of A.

35:29

J. 's folks, Mike Miele, we talk about that all the time.

35:32

He'll be on that spreadsheet or we'll be having that discussion where somebody just

35:35

comes in and buys the business or shadow prices the, the lowest possible number.

35:41

And it's like, what are you buying? You could save $100,000 on the front end, on the back end,

35:45

it's going to cost you millions. Another thing that I have heard sometimes gets charged for within this claims

35:51

wire in the process of paying for claims is spread pricing and medical claims.

35:57

And I've certainly, I'm sure everybody who listens has heard this relative

36:01

to pharmacy claims, but there's medical claim spread pricing as well.

36:05

We certainly think it exists. It's hard to say exactly where and how it's happening.

36:10

It's obviously, as you said, known within PBM pricing, the J&J complaint

36:15

discusses it in some detail. It's thought that it is happening on the medical side, although we

36:19

don't have hard definitive proof, but we have enough evidence that

36:23

we think it sure is happening.

36:26

This is personal to me. Many know that there's a complaint filed with the Bricklayers,

36:30

Local 1 in Connecticut, and Sheet Metal Workers against Anthem.

36:34

The Bricklayers are a client of ours.

36:36

One of the allegations is that there's money added to the actual cost of

36:40

a claim that either goes into the pocket of the insurer or provider,

36:43

which is still to the benefit of the insurer, who would otherwise be

36:47

on the hook for the compensation if it's being paid to said provider.

36:51

Yeah. So just understanding what a spread is, is that the plan sponsor is

36:57

being charged a hundred bucks for some claim, but the provider is

37:03

only being reimbursed 50 bucks.

37:06

Therefore somebody in the middle, just made 50 bucks.

37:10

It doesn't disappear into the ethos.

37:12

And as we have more transparency files, machine readable files that are

37:16

made available, where we can look at specific procedures, services, and then

37:20

compare what the publicly posted price is for negotiated rates, we can start

37:26

to ask some very poignant questions. But even look at the DOL case against Blue Cross Blue Shield of Minnesota.

37:32

It involves spread pricing if the provider agreement says it is the

37:36

obligation of Blue Cross Blue Shield to pay the shifted provider tax.

37:40

It's a hidden fee that gets pulled in. So that's the whole basis of the lawsuit.

37:44

So does it exist? I would argue, yes.

37:47

Interesting. So basically what you're saying is that there, there are indications to show

37:53

that what the providers are charging for any particular claim might be less than

37:58

what the plan sponsor is getting charged.

38:00

Therefore there's dollars in the middle, which is often referred to as the spread

38:03

and relative to this DOL, Department of Labor case against BCBS Michigan, I think.

38:09

What was going on there is that the plan sponsors were unbeknownst to them paying

38:14

taxes on behalf of providers, right?

38:16

So the providers have to pay taxes, and it turned out plan sponsors

38:19

were paying provider taxes. And to your point, you're like, how are they paying providers taxes?

38:25

If there wasn't dollars in the middle there, which were being added to

38:29

claims that the plan sponsors were told, oh, you're paying claims.

38:33

You got it. See, listen, it doesn't take a rocket scientist.

38:37

It just takes a little bit of sleuthing to connect the dots and understand that this

38:40

is just another form of spread pricing. Justin Leader, is there any place where you would recommend people

38:47

go to learn more about your work?

38:50

I put a lot of information out there on LinkedIn.

38:52

So look for me on LinkedIn, Justin Leader, the one out of Pennsylvania,

38:57

not the one out of California. You can also go to benefitsdna.com or wefixyourhealthcare.com.

39:03

And I would highly recommend following Justin on LinkedIn.

39:07

We will link to Justin on LinkedIn as well as the two

39:11

websites that he just mentioned.

39:13

Justin Leader, thank you so much for being on Relentless Health Value today.

39:16

Thank you, Stacey. I'm a big fan of your podcast as I've shared time and time

39:21

again, I'm a bit of a fan boy, so it's an honor to be here today.

39:24

So let's talk about going over to our website and typing your email address

39:28

in the box to get the weekly email about the show that has come out.

39:32

Sometimes people don't do that because they have subscribed on iTunes or

39:36

Spotify and or we're friends on LinkedIn.

39:40

What you get in that email is a full and unredacted, unedited version of the whole

39:47

introduction of the show transcribed.

39:49

There's also show notes with timestamps, so you get everything

39:52

that you need to decide if you want to listen or not, just apprising you

39:55

of the options that are available. Thanks so much for listening.

From The Podcast

Relentless Health Value™

American Healthcare Entrepreneurs and Execs you might want to know. Talking.Relentless Health Value is a weekly interview podcast hosted by Stacey Richter, a healthcare entrepreneur celebrating fifteen years in the business side of healthcare. This show is for leaders in pharma, devices, payers, providers, patient advocacy and healthcare business. It's for health industry innovators, entrepreneurs or wantrepreneurs or intrapreneurs. Relentless Healthcare Value is the show for you if you want to connect with others trying to manage the triple play: to provide healthcare value while being personally and professionally fulfilled.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

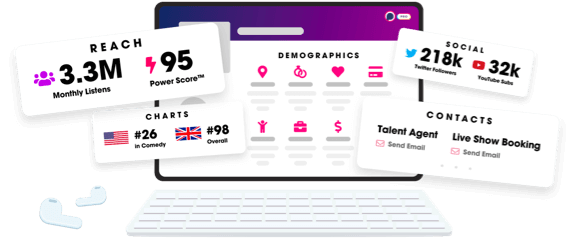

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us