Money Tree Investing Podcast

Money Tree Investing

2 people rated this podcast

Money Tree Investing Podcast

Money Tree Investing

2 people rated this podcast

Rate Podcast

Episodes of Money Tree Investing

Mark All

Search Episodes...

Stan "The Annuity Man" Haithcock shares annuity truths and how to make informed decisions. Stan's all about cutting through the fog of annuities, giving it to you straight. We've had him on before, and it's always a good time. With a background

Let's talk about the meme stock craze and how it impacted Jim Simons! Today we also highlight rising credit card and auto loan delinquencies, the depletion of post-pandemic savings, and financial strains from higher costs of essentials amid hig

Chad Willardson shares insights into how to he helps to encourage good financial habits for entrepreneurs. Chad shares his journey from Merrill Lynch to founding his own firm and sheds light on the rollercoaster ride of managing finances for en

There are so many different narratives of investing that it's important to know when you need to think twice. Today we delve into the murky waters of legislative bills and how they're often loaded with hidden surprises. We also navigate the lab

James Davolos from Horizon Kineticsm discusses the challenges of conventional wisdom in the world of investing. This exciting discussion delved into the intricacies of market dynamics, particularly focusing on the enduring trend of growth outpe

Did you know your brain is broken? Today you find out why! In this episode we talk about coffee and humor and of course the stock market. We get into some deep stuff about cognitive dissonance and how it messes with our heads. Of course the con

Joseph Furnari comes on to discuss his technical analysis model for investment strategies. By combining fundamental knowledge with technical insights, Joe has crafted a simple yet effective model that prioritizes key indicators such as stock pr

Kristen Ragusin joins us to explore central bank digital currencies (CBDC). Kristen has had quite the journey with money. It all started when she was just five years old, earning her allowance by explaining stock markets to her dad. After colle

Today we talk about chart crimes! We dive into how charts can sometimes tell a misleading story. We have to stress the importance of looking beyond the surface and understanding the narratives behind the data. This chat is full of insights into

We're spending time answering your listener questions about investing! Picture diversification like a balanced diet for your money, protecting against market surprises. Learn from mistakes to avoid emotional investing pitfalls. Doug warns about

We discuss the life of Daniel Kahneman, a pioneer in behavioral economics who challenged conventional economic thinking. His work reshaped how we view decision-making and market behavior. We also discuss investment strategies, touching on the i

This week we interview Dave Foster, a 1031 expert and Qualified Intermediary. We dive into the benefits of using 1031 exchanges and how it can enhance the returns of your real estate investments by savings on taxes. Today's Panelists: Kirk C

We explore stock market expectations and how to affect your performance. Is your crystal ball a bit foggy? That uncertainty sends stock prices on a wild rollercoaster ride. Watch out for curveballs, like when interest rates and stocks go on tot

Dive into the world of investing in EFTs as we're joined by Bruce Bond, a seasoned expert who's been around the block in the industry. Bruce brings a wealth of experience, having started from the ground up, selling bonds and eventually venturin

The market's going up and someone has to be to blame! This week we help you understanding the complex forces driving the market highs in 2024. We delve into the trends of the market and various forces at play, seeking to provide listeners with

Jordan Berry went from being a pastor to striking gold investing in laundromats. His journey's a rollercoaster, from dreaming of Hawaii to diving into the world of laundry. Jordan shares the highs and lows, from snagging laundromats to facing u

Another week in the markets and the idea of a potential civil war and the stock market. Another eventful week in the markets, with little significant change. Why so quiet? Discussion revolves around the recent Fed meeting and its implications

I'm thrilled to host Yossi Sheffi, a distinguished professor at MIT known for his expertise in supply chain dynamics. Today, we're diving into the disruptions experienced by supply chains during the pandemic. Professor Sheffi's insights will sh

This week we discuss all sorts of great topics such as where to find great opportunities in an expensive market. Why everyone is bearish. And most important, why it pays to be a bull. We're diving into the world of current stock market opportu

This week we have Doomberg join us, the prolific writer behind the Doomberg Substack, a renowned for insightful commentary and analysis on global energy dynamics and the current energy crisis under the surface. Doomberg's expertise delves deep

Join us to see what happened this week causing a rocket ship ride higher in many assets. crypto, gold, US stocks, international stocks, Japan, and more. Also we discuss the state of the union address, Stanley Druckenmiller, chart crimes and mor

I'm thrilled about today's discussion, Water Investment Opportunities, because we have the privilege of hosting Riggs Eckelberry, a seasoned expert whose upbringing as a corporate guy provided him with a unique, global perspective on the world.

Why is a raven like a writing desk? I still cannot answer that question. But Japan, Reddit and the moon are all related. Japan recently hit all time highs in the stock market, the moon was conquered by a private company and Reddit will IPO soon

This week we dive into the world of technical traders. We discuss the Risk Management Checklist, allocation, styles, quantity of trades, tactical strategies the psychology of investing and more. Having a process is important. The best process

This week we discuss the true cost of the American dream, when the next market sell off will start, and why the financial markets are drastically underestimating inflation. We also discuss why office REITs are in trouble, and druckenmiller's r

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

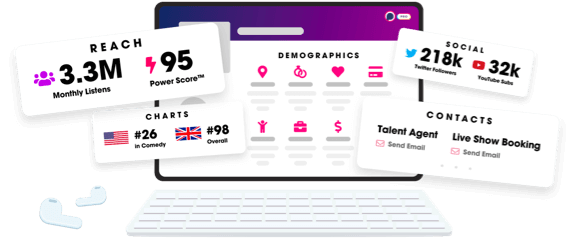

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us