Dan Danford’s grandfather used to say “Rocking chairs have killed more people than any disease ever could.” His wisdom rings true today. Most people will have a 30-year retirement, which is a longer time span than many people realize or predict. Money is just a tool in retirement to help you accomplish what you want to accomplish. The more important question is what do you plan to do? The answer to this question (how you’ll get up each day, get out and interact with people) is a key piece of a successful retirement formula. Listen today for more insights from Family Investment Center Founder/CEO Dan Danford on this exciting season called retirement.

Show More

Rate

From The Podcast

Money is Freedom

Welcome to Money is Freedom, a podcast for people who believe in simple, jargon-free guidance about money and investing. It's also a podcast for people who believe money can be fun and want to guide their thoughts about it in positive directions. Our host, Dan Danford, serves as President and Chief Executive Officer of Family Investment Center, a full-service, commission-free investment advisory firm. Based in St. Joseph, Mo., Family Investment Center serves clients in the Kansas City area and across 13 states. You'll see his name and those of his team across publications like The Wall Street Journal, U.S. News and World Report, Forbes, Kansas City Star, Chicago Tribune, BusinessWeek and more -- often surrounding somewhat unconventional (but absolutely smart, experience-driven and level-headed) information about money. If Dan's wisdom has been called upon by these sources for its uniqueness and savvy, it's because he has had a unique journey. He began his investment career more than 30 years ago as a bank trust officer, where he decided there must be a better way to help people reach their goals. He started a successful independent trust company in 1987 and Family Investment Center in 1998. He has been helping people achieve their version of "the good life" in a refreshing commission-free atmosphere ever since. (In fact, client Assets Under Management exceeds $100 million).Having seen first-hand the many ways bank trust and investment companies work and provide services, he feels strongly that a commission-free firm offers a better way for most people to receive independent, objective advice at reasonable rates, with a high level of personalized service. Now that this type of advice has become popular (and soon mandatory) it's business as usual at Family Investment Center. Dan holds a bachelor's degree in Marketing from Missouri Western State University, an MBA from Northwest Missouri State University, and an MS in Personal Financial Planning from Kansas State University. He is a CFP® and strongly influenced by his late father, Thad Danford, who made him rent the family's mower for Dan's early lawn mowing business.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Do you host or manage this podcast?

Claim and edit this page to your liking.

,Claim and edit this page to your liking.

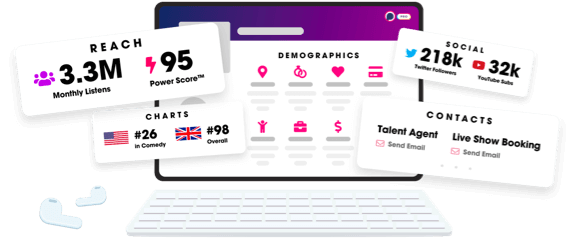

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us