A business owner’s lack of transparency with his M&A Advisor ended up taking his business sale from a sure deal to zero and the IRS killed this deal without breaking a sweat.

A buyer walked away from a deal allowing the seller to re-sell the business again in a matter of months and keep all the sales proceeds from the first deal in a practice called double dipping.

If you are growing your business through acquisitions, regardless of how messy an acquisition is, these can become your most profitable deals.

Taking reasonable risk in selling your business can turn out well for all parties if you manage this type of risk prudently.

Eric Gagnon

We Sell Restaurants

Palm Coast, Florida

Visit Website

Send E-mail

The post How the IRS Can Kill a Deal Without Breaking a Sweat appeared first on Business Exit Stories.

Hosted on Acast. See acast.com/privacy for more information.

From The Podcast

Business Exit Stories

Hosted by Marvin L. Storm, the Business Exit Stories Podcast shares dramatic success as well as unfortunate horror stories of business exits, and in collaboration with BxAdvisors assists Founder/Business Owner CEOs in creating enterprise value in their companies by as much as 100%. Not only is business value enhanced, but the company is positioned for a high-value monetization event without wasting time and money through the application of time tested value creation strategies. Hosted on Acast. See acast.com/privacy for more information.Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

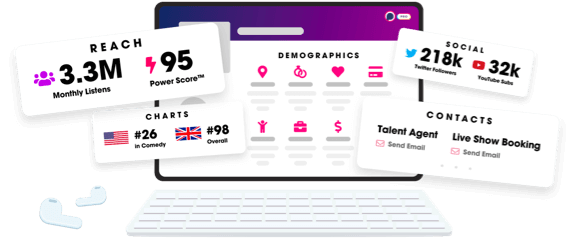

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us