Summary

In this episode, Ryan Burklo and Alex Collins discuss the concept of true liquidity and its importance in retirement planning. They explain that true liquidity goes beyond cash reserves and savings, and involves considering what assets will be accessible and how to turn them into income during retirement. They highlight the risks of relying solely on market-based assets for income in retirement and the potential for compounding losses. The hosts introduce the concept of true liquidity as a way to mitigate these risks by having a separate bucket of money that is not correlated with the market. They provide examples and calculations to illustrate the impact of true liquidity on retirement outcomes. They emphasize the need to start building true liquidity before retirement to ensure flexibility and avoid relying on market performance during critical years.

If you would like to learn more about Quantified Financial Partners, please visit our website www.beerandmoney.net

Takeaways

True liquidity goes beyond cash reserves and savings and involves considering what assets will be accessible and how to turn them into income during retirement.

Relying solely on market-based assets for income in retirement can lead to compounding losses and increase the risk of running out of money.

True liquidity can be achieved by having a separate bucket of money that is not correlated with the market, providing stability and flexibility in retirement.

Building true liquidity should be started before retirement to ensure flexibility and avoid relying on market performance during critical years.

Chapters

00:00 Introduction

00:36 Misunderstanding of Liquidity

02:31 Planning for Retirement

03:12 Explanation of True Liquidity

07:14 Effects of Market Losses in Retirement

08:11 Concept of True Liquidity

10:07 Example of Market Performance

13:35 Importance of Pre-Retirement Liquidity

19:13 Building True Liquidity

21:24 Question of the Day

From The Podcast

Beer & Money

Welcome to Beer and Money, a financial fireside chat for business professionals. We work to simplify your finances so that you can enjoy your life. Your hosts, Ryan Burklo and Alex Collins are financial advisors based out of Seattle, Washington. This material is intended for general public use. By providing this material, we are not undertaking to provide investment advice for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact one of our financial professionals for guidance and information specific to your individual situation. Guardian, its subsidiaries, agents and employees do not provide tax, legal or accounting advice. Consult your tax, legal or accounting professional regarding your individual situation. Securities products and advisory services offered through Park Avenues Securities LLC (PAS), member FINRA, SIPC. OSJ 333 N. Indian Hill Blvd, Claremont, CA, 909-399-1100. PAS is a wholly-owned subsidiary of Guardian. Quantified Financial Partners is not an affiliate or subsidiary of PAS or Guardian. Ryan Burklo, AR Insurance License # 15319412, CA Insurance License # 0K24924, Alexander Collins AR Insurance License # 7264699, CA Insurance License # 0H24806. #2022-133647 Exp 02/2024Visit our website www.QuantifiedFinancial.comJoin Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

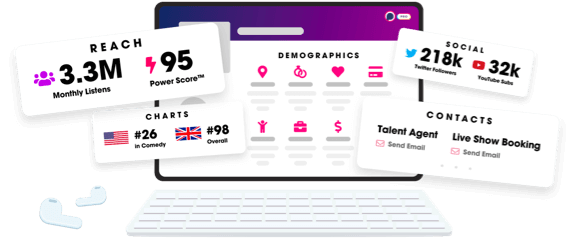

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us