The rags-to-riches tale of Palmy and Nancy Kitti encapsulates more than just financial success; it's a poignant narrative of resilience, grit, and the astute harnessing of private money to create a real estate empire. Their journey, recently spotlighted by Jay Conner on the "Raising Private Money" podcast, provides invaluable lessons for aspiring entrepreneurs and investors alike.

The Power of Starting Small

The Kitti sisters began their entrepreneurial pursuits with only $2,000 in their bank account—a sum that is hardly considered sufficient for massive business undertakings. Their success story is a testament to the fact that with the right strategies and mindset, starting small does not equate to thinking small. In their interview, the sisters detailed how they pivoted from a failing fashion venture to flipping houses, eventually moving into multifamily investments. This progression underscores the importance of adaptability and the willingness to enter unchartered territories, despite initial lack of expertise.

Cultivating a Tribe: Beyond Networking

One of the standout themes from the podcast was the sisters' focus on building a tribe rather than merely expanding a network. According to Palmy and Nancy, creating deep, value-driven connections is paramount. They stressed the notion that giving value first and leading with education pays dividends in the long run. This approach has not only enabled them to raise over $130,000,000 in funding but has also established a robust foundation of trust and reliability with their investors.

Leveraging Existing Skills and Expertise

Transitioning from the fashion industry to real estate might seem like a leap too vast for many, but for Nancy and Palmy, it was a calculated shift that involved transposing their business acumen to a new arena. They encourage emerging real estate entrepreneurs to leverage their existing skills and experiences, suggesting that many competencies are transferable and can provide a competitive edge in real estate dealings.

Demystifying Capital Raising

A critical highlight from the discussion was the sisters' strategy to debunk the myths surrounding capital raising. Contrary to the popular belief that one needs a vast network of wealthy acquaintances to start raising capital, they emphasize the importance of team expertise and the ability to showcase knowledge and capability. They also touched on leveraging social media platforms like YouTube, Instagram, and TikTok to amplify their presence and attract like-minded investors.

Building an Investor Attraction Flywheel

The Kitti sisters introduced the concept of an 'investor attraction flywheel,' a novel strategy that combines the savvy use of social media with consistent networking to attract potential investors. This system not only helps in aligning with investors who share similar values but also ensures that there’s a continuous influx of funds necessary for sustaining and expanding business operations. Palmy's emphasis on authenticity in social media presence further ensures that connections made are genuine, paving the way for stronger, more sustainable investor relationships.

Focusing on Education and Empowerment

In wrapping up their heartening interview, Nancy and Palmy invited listeners to participate in their "Raise More Money Challenge." The initiative is tailored to educate aspiring real estate moguls on overcoming the mental and practical hurdles of initial capital raising. This aligns with their overarching philosophy of leading with education and serving the community, facilitating a more knowledgeable and empowered tribe of investors.

Conclusion

The narrative of Nancy and Palmy Kitti is not just inspiring but also illuminating. It serves as a powerful reminder that with the right mindset, strategies, and a focus on building meaningful relationships, anyone can transform modest beginnings into monumental achieveme

From The Podcast

Raising Private Money with Jay Conner

I’m Jay Conner, also known as the Private Money Authority. Did you know that as a real estate investor, you are missing out on 87% of the deals because you’re “not” leveraging private money? After two decades as an investor, I started the Raising Private Money podcast to help you unlock all the private money you'll ever need to fund your real estate deals - WITHOUT resorting to expensive hard money loans.If you’ve ever lost out on a great off market deal because you lacked the financing, then you and I are kindred spirits. I’ve been there too, missing seller financed opportunities early on because I didn’t know any better.On this podcast, we’ll walk through accessing private funding together. You’ll discover:•How to position yourself to tap into flexible private money funding rather than restrictive, costly hard money loans•Untapped funding sources like self-directed IRAs – and many others you may not be aware of•Steps to build your own network of private lenders for repeat financingI speak with wholesalers, flippers, rehabbers, and investors in every niche about where they were BEFORE private money, and how adding private money has EXPLODED their profits!Whether you’re a new investor looking to quit your 9 to 5 job and finance your first deal or an experienced investor aiming to do more deals and generate bigger profits, private money is out there waiting for you.You just need the right mindset, positioning and tools.Visit JayConner.com to join me on this journey and fund your first (or next) deal. All the capital you need is closer than you think. Let’s get there together!Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

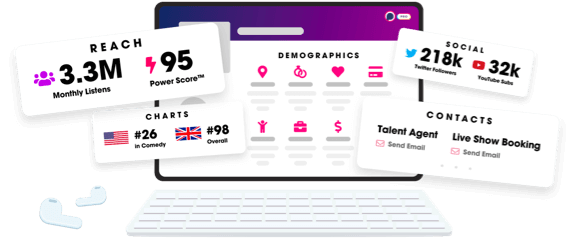

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us